The coalition government has released their first budget, laying out how the government will spend its money over the next year.

We’ve read through it and unpacked the biggest takeaways, so you don’t have to.

The coalition government’s first budget follows through on many of the campaign promises made by National, ACT, and NZ First – to cut back government spending and deliver tax breaks, while reinvesting in targeted frontline services like health, police and infrastructure.

In the next year, the government projects it will bring in $136 billion in revenue (from taxes, GST etc) and spend $144 billion on services, like schools and hospitals.

Since 2019 the government has spent more than it makes each year, but the coalition government is attempting to switch that by 2026.

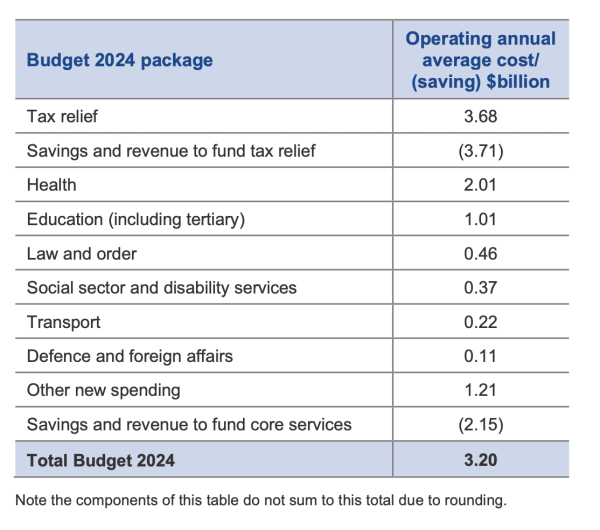

This budget package allocates $3.2 billion in funding for a range of projects and services in the next year, but as the first budget of a new government it often reveals plans for spending over the next four years.

The summary of the 2024 budget package.

Here are five key areas of the budget you should know about:

Tax cuts

Tax systems are confusing as hell, but stick with me here because these changes will likely impact you.

A key element of the National Party’s 2023 campaign was their promise to reduce the amount of taxes the majority of New Zealanders pay.

This budget includes a $3.7 billion tax relief package, which the government said will save 1.9 million households an average of $60 a fortnight.

These tax savings will be achieved through four tweaks to the tax system:

Raising the personal income tax thresholds, so you now have to earn more in order to go up a tax bracket.

- For example, currently if you earn over $48,000 a year you pay30% in income tax. With the Budget announcement, that 30% threshold has been raised to $53,500 a year.

- Four brackets between $14,000 a year and $180,000 a year have been raised.

Raising the eligibility threshold on the Independent Earner Tax Credit, which gives tax back to people working full-time and not receiving other government benefits, such as Working For Families.

- Previously you were only eligible for this credit if you earned between $24-48 thousand a year, now it has been raised to $48-70 thousand a year.

- This adjustment means 420,000 more people will be eligible for up to $20 a fortnight.

- Increasing the in-work tax credit, usually given to working couples with kids, by $50 a week.

- There are an estimated 160,000 households eligible for this credit

- The government has introduced the FamilyBoost plan, which offers families with kids in early childhood education (ECE) a rebate of up to $150 a fortnight. This replaces a Labour government programme which offered 20 hours free ECE for 2-year-olds.

How much people will save on taxes varies based on your circumstances.

The government’s tax calculator highlights a couple with two children, two of which in ECE, will receive the highest amount of savings, with $271 a fortnight.

The calculator estimates a minimum wage worker will save $25 a fortnight, a single adult making $55,000 a year will save $51 a fortnight, and a couple with no kids earning $150,000 a year would save $80 a fortnight.

These tax changes will be applied from July 31 this year, and FamilyBoost will be available from July 1.

This tax relief package has been paid for primarily by:

- reducing the cost of running government departments ($1.22 billion)

- closing Labour programmes ($780 million) such as the clean car discount and public transport subsidies

- reallocating climate funding ($600 million) including uncommitted funds from the Climate Emergency Response Fund and canceling some projects funded by Emissions Trading Scheme revenue

- and changing the first year fees free programme, to final year fees free ($220 million). The Labour government programme offering the first year of tertiary education fees free has been changed so that now the final year of tertiary education is fees free.

Health

The government has committed $16.68 billion of additional funding to the health system over the next four years.

The bulk of this, $5.5 billion, is to bolster the hospital, GP and specialty services of Health NZ.

The other major spend is an additional $1.77 billion to increase the range and availability of medicines through Pharmac.

Other services funded in the budget include

- $24 million to support the free mental health counseling through Gumboot Friday

- $22 million to train 25 more doctors a year

- and $31 million to increase security in emergency departments

Education

The budget includes a $2.9 billion investment in the education system over the next four years, largely focussed on upgrading and building new schools and classrooms.

There is

- $1.5 billion for building a maintaining schools and classroom facilities

- $163 million to maintain IT infrastructure in schools

- and $153 million to establish charter schools

The other major education expenses over the next four years are

- a $200 million increase of the grants available to cover operating costs for lower socio-economic schools

- almost $500 million to continue the slightly tweaked school lunch programme for another two years

- $56 million to increase the number of teachers

- and $67 million to expand the Structured Literacy Programme.

To help pay for this, a range of programmes have lost their funding – including arts programmes, Māori education programmes, and the Prime Minister's Excellence award.

Law and Order

Police and prisons were a big focus of the election campaign, and the government has now allocated $2.9 billion to law and justice services over the next four years.

Two thirds of this, $1.9 billion, are for the Department of Corrections, to increase the number of Corrections workers, fund prison reform programmes, and to increase prison capacity.

More than $650 million is earmarked for the Police, with a third of that to deliver the promised 500 extra Police officers by the end of next year, and the rest to increase Police pay and purchase new vehicles.

Another election promise from the National Party was to crackdown on youth crime. The budget commits to this by allocating $30 million to set up the National Party's proposed military-style youth boot camps.

Other Budget highlights

The budget allocates funding to a range of programmes you might be interested in, across culture, health and support services.

Here are some highlights:

- A $1.1 investment in the Ministry of Disabled People over the next five years

- An additional $48.7 million in funding for Te Matatini, the national kapa haka festival

- $1 billion to aid the recovery following Cyclone Gabrielle and the Auckland floods

- $15 million of funding over 4 years for the Ikura programme, which offers free period products in schools

More stories:

In THIS economy? How young business owners are currently holding up

A business association spokesperson explains what it’s like for young entrepreneurs right now.

Penis problems: A sex expert answers your questions

From ‘why do men cum fast?’ to ‘is blue balls a real thing’?

Why I wore cultural clothing to graduation

“My outfit means representing my family at graduation and showing where I am from.”