This story is part of Re:’s Money Week, where we take a look at everything from asking your boss for a raise, to explaining what inflation actually is. Check out the rest of the stories here.

When McDonald's opened in New Zealand in 1976, a Big Mac cost just 75 cents.

It’s now $7.10.

It might sound like McDonald’s is charging eight times more but the burger actually costs almost the same amount when you account for inflation.

Inflation is how we describe prices for goods and services going up over time.

In the economy, a cost rise of one thing often impacts the price of many others.

For example, if oil becomes more expensive, transporting goods becomes more expensive and that makes those goods more expensive to buy.

Prices get pushed up by a bunch of things:

- A business gets charged more for supplies and puts up prices on products and services.

- More people want an item but if there’s only a few available this allows a business to charge more for it.

- There is disruption or a shortage of something and so prices get pushed up of everything that uses that thing somewhere in their supply chain.

Underlying all of these reasons is our capitalist economic model. This is driven by trying to make as much money as possible from a good or service.

Inflation is actually a reflection of how much a country’s money is worth

To use money, there has to be a collective belief and understanding of its worth.

Once upon a time, we did this through trade - where we would say ‘my one apple is the equivalent worth of your one pear.’

But in our current economic system, we collectively agree on the value of money.

For example, we exchange our labour for pieces of paper (or numbers in a bank account).

We do this because we understand what the relative worth of those numbers will be for the things we need to buy. We also have trust that those numbers will be exchangeable for those things.

As inflation occurs the worth of those dollars decreases which means we need more of them to buy goods and services.

For an economy to be healthy, price rises need to remain small across all goods and services

Each country adds up the amount goods and services go up each year to calculate the inflation rate.

New Zealand has a target of limiting that rise to 1 to 3% a year.

Let’s say you go to the supermarket and buy $100 of groceries today.

If the system is working right, next year those same groceries should cost between $101 and $103.

The key to making this work is to keep all of the costs relative to the strength of the economy.

That is why the Big Mac is pretty much the same price now as it was in 1976, because it was the same price relative to the strength of our economy.

When judged against the growth of the economy, a 75 cent burger in 1976 is worth $7.27 in today’s New Zealand dollar - more than the $7.10 it currently sells for.

Where this system fails: it doesn’t reflect inequity

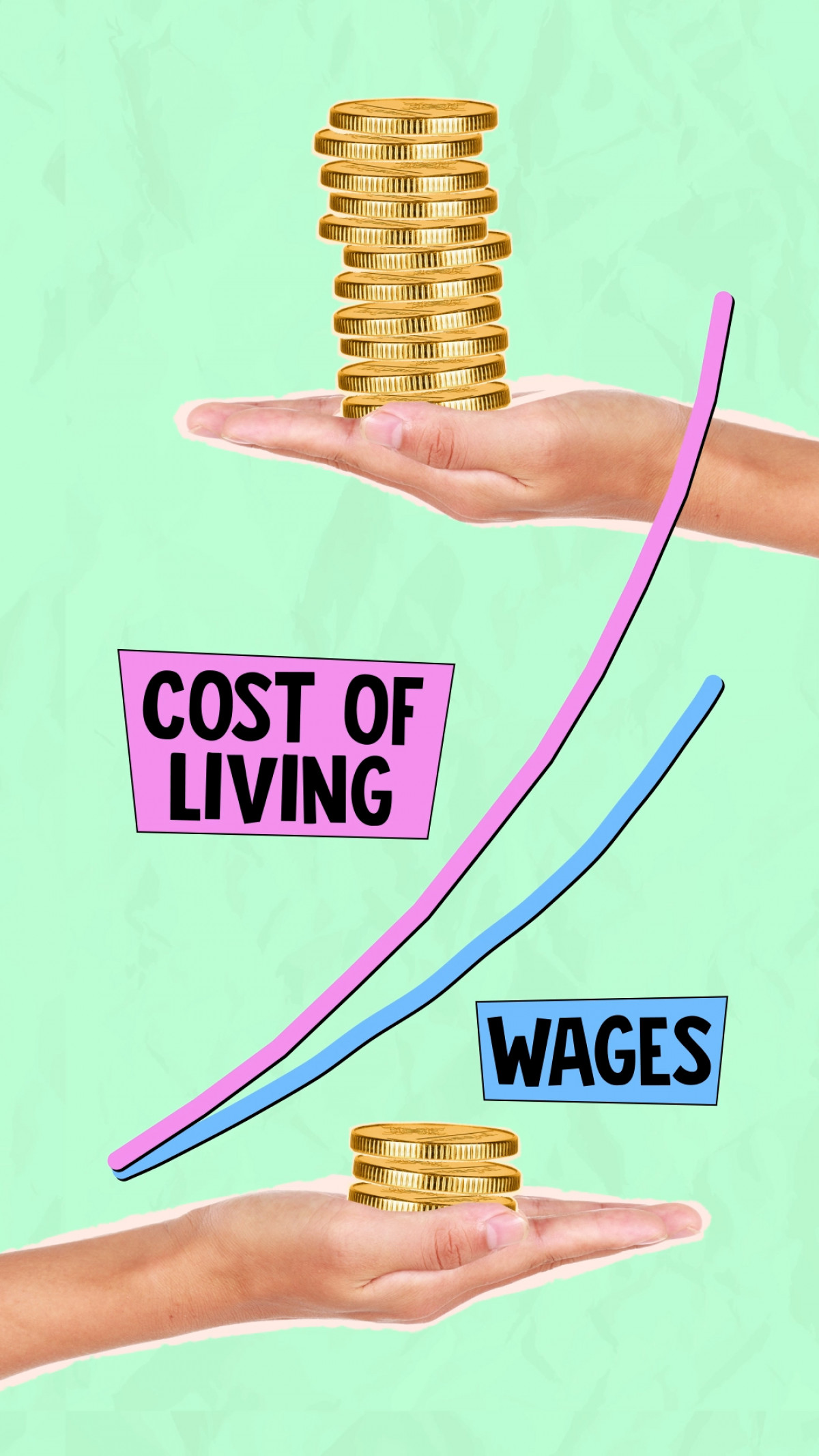

In those almost 50 years of inflation, a massive wealth disparity has occurred and average wages have massively lagged behind inflated costs.

Take again what percentage of minimum wage incomes a Big Mac represents:

If the rise in the cost of living matched the rise in how much people made, it would simply be the process of bartering in larger and larger numbers.

But because it hasn’t, inflation is a map of the widening inequity of our society.

Inflation demonstrates how businesses have worked to make as much money as possible without distributing the money made equitably.

Inflation does not affect people equally.

The less money you have, the harder the effects of inflation will be to manage.

Especially because inflation is most clearly seen on basic needs like food, accommodation and transportation.

More Money Week stories:

Welcome to Money Week

News Editor Mandy Te outlines our money coverage.

How to ask your boss for a pay rise

Asking for a raise can feel awkward, uncomfortable and just plain terrifying.